Things You Need To Know After Our System Upgrade

The entire Blue Water Federal Credit Union staff would like to "Thank You" for your patience and understanding as we worked through our System Upgrade.

In an effort to cut down on call wait times, we will be utilizing a call center for the first two weeks starting on August 4, 2025. Call center representatives will be assisting with online account logins, and other general member service questions. All other inquiries will be redirected back to the credit union staff for further assistance.

Additionally, wait times in our office may be longer than normal as we assist members with our new and improved services.

Why Did We Upgrade Our System?

In 2023, Blue Water Federal Credit Union learned that our current processing system was being phased out and we needed to start looking for a product to replace it. We carefully researched our options and after months of evaluation decided to go with CU*Answers as our new processor. We feel this system will allow us to offer more advanced technology and better services for our members.

What Stayed The Same After The Upgrade?

Member Account Numbers

Your existing account number(s) remain unaffected by our system upgrade. However, account suffixes have changed.

NOTE: Though your primary account number did not change, the account suffixes changed. Before setting up a new direct deposits, electronic transactions, or ordering checks, please contact us to verify you have the correct information.

Checks

Although your account number remains the same after the system upgrade, the MICR number on your checks will change upon re-order. Please contact the credit union before setting up any new direct deposits or electronic transactions to obtain the correct routing number and account number. You can continue to use your current supply of checks.

ATM/Debit and Credit Cards

You will continue to use your same ATM/Debit, and Credit Cards post conversion.

Direct Deposit of Payroll, Pension, and Social Security

Your direct deposits will continue to post to your account as they do today.

What's New After The Upgrade

eStatements

With our new system upgrade, we’re excited to offer eStatements—adding an extra layer of security and convenience to your banking experience. Your monthly statements will be safely stored within Online Banking, and you’ll receive an email notification each time a new one is available. Sign up through your Online Banking account on Monday, August 4th to begin receiving your eStatement.

Benefits include:

- Receive your statement faster

- More safe and secure

- Convenient – access your statements from any web connection

- Easy access to prior statements – 12 months of eStatements available

- Print only when you need to

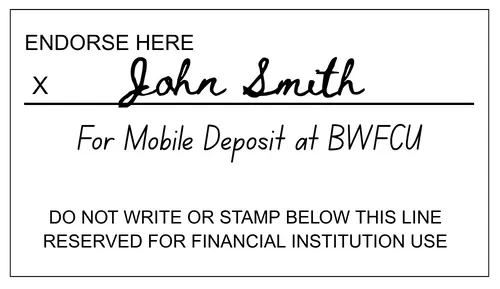

Remote Deposit Capture

As part of our system upgrade, we’re introducing remote check deposit through our mobile app, enabling you to securely deposit checks at your convenience without the need of visiting the credit union. Simply snap a photo of the front and back of your check using your smartphone’s camera and deposit it electronically.

Stay tuned for announcements on our website, we will update you once this new feature becomes available.

Checks must be signed and endorsed with one of the following:

- Mobile Deposit at Blue Water FCU

- Mobile Deposit Only

- Mobile Deposit at BWFCU

- Remote Deposit at BWFCU

Bill Pay

As part of our system upgrade, we're also introducing Bill Pay which integrates seamlessly with our new online and mobile banking systems, making it easy for you to pay bills and manage your finances from wherever you are on any device you choose.

Visit www.bluewaterfcu.com/how-to-videos to view “how to” videos on a number of bill pay topics, including how to enroll, adding a payee, or setting up a new e-Bill.

|

|

Person-to-Person (P2P) Transfers

Pay anyone, anytime, anywhere with Person-to-Person (P2P) integrated within our new online Bill Pay service. Forget the hassle of carrying cash. Easily use the P2P feature to securely transfer money from your account to any friends or family's account.

Account-to-Account (A2A)

It’s Me 247 allows you to transfer funds between your Blue Water Federal Credit Union accounts and your accounts at other financial institutions. Prior authorization and setup are required. Please contact the credit union after August 4th to begin the process.

Card Controls

With Card Control available through It's Me 247, members can temporarily lock their debit cards for added security. They can also set up real-time alerts to monitor activity such as authorized transactions, card-not-present purchases, and foreign transactions.

eNotices

Why wait for notifications to arrive by mail? With eNotices, you’ll receive timely alerts directly through your online banking or email. Get notified about important account events like overdrafts and non-sufficient funds, and take control of your finances with customizable options. You can also set up low balance alerts, payment reminders, and more — all designed to help you stay on top of your money, anytime, anywhere.

It's Me 247 Online Banking

Our upgraded online banking system will provide a much more user- friendly and stable online banking service. It’s Me 247 allows you to bank online, when and how you want. It’s online banking with you in mind.

Starting Monday, August 4th, members will be required to re-enroll in our new online banking. Visit our website, www.bluewaterfcu.com, click on “Log On”, then select “First Time User”, and follow the prompts.

Our enhancements give you the ability to do the following:

- “See” and “jump” to your joint accounts without logging out of your primary account. Please contact Blue Water Federal Credit Union to set up this feature.

- Adjust how your direct deposit and other electronic deposits are allocated within your accounts

- Review loan payoff amounts

- Read important messages from Blue Water Federal Credit Union

- Stop payment on a check

- View eStatements

- Transfer funds between accounts, enter text that describes a transaction at the time of the transfer

- Temporarily freeze debit card

- Coming Soon! You will be able to check your VISA credit card balance. Check our website for updates

- Re-order checks

It’s Me 247 Mobile App

Our new mobile app is coming soon!! We are working on redeveloping our mobile app and it will be available shortly after our system upgrade. Mobile banking will be more user-friendly and provide more functionality, including these features:

- Mobile check deposit

- Mobile bill pay

- Ability to see transaction details when viewing history

- Ability to apply for a loan

We will keep you updated when the new and updated mobile app is available for download in the Apple App Store and Google Play Store.

Apple users will need to update their current app through the Apple App Store. Android users will need to delete the current Blue Water FCU app and re-download it from the Google Play Store.

Stay tuned for announcements on our website. We will update you as soon as the new apps become available.

What's Changed After The Upgrade

Payroll Deposits

After the system upgrade, direct deposits will be posted on your scheduled date rather than a day early. Please see the example below:

New Account and Loan Suffixes

Although your account numbers remained the same, your account suffixes have changed. Please make note of the new account suffixes as you make loan payments and/or refer to your specific accounts with questions and maintenance.

| Personal Accounts | Old Suffix | New Suffix |

| Savings | A | 000 |

| Special | S | 010 |

| Holiday | H | 020 |

| Money Market | M | 030 |

| Checking | X | 100 |

| IRA | I | 200 |

| Certificate of Deposits | Any | 300-350 |

| Loans | Old Suffix | New Suffix |

| Installment | Any | 500-510 |

| Un-Secured / Signature | Any | 520-530 |

| Home Equity 5 Years or Less | Any | 700-710 |

| Home Equity Over 5 Years | Any | 720-730 |

| Revolving Line of Credit | Any | 800 |

| Checking Line of Credit | Any | 810 |

New and Updated Service Fees

With the implementation of new features, we have revised our fee schedule. Please refer to the table below for details, or click here to view our entire fee schedule.

| Item | Note | Fee |

| Revised Service Fees | ||

|---|---|---|

| Dormant Account | per month after 12 months of dormancy | $5.00 |

| Stop Payment | per item or block | $10.00 |

| New Service Fees | ||

| Bill Pay Fee | per month | FREE |

| Bill Pay Stop Payment | per item stopped | $10.00 |

| Paper Statements | per month | FREE |

| Counter Checks | 4 per page | FREE |

| Non-Member Check Cashing Fee | per item | $5.00 |

System Upgrade FAQ